Systematic Risk : List Of The Systematic Risk Factors For Wind Energy Investments Download Scientific Diagram : Systematic risk refers to the risk intrinsic to the complete market or the complete market segment.

Market (or systematic) risk whereas idiosyncratic risk is the risk for an asset to experience losses due to factors that affect the entire stock market and . Systematic risk is risk associated with market returns. Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control. Systematic risk refers to the risk inherent to the entire market or market segment. This is risk that can be attributed to broad factors.

/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)

Systematic risk, also called market risk, is risk that's characteristic of an entire market, a specific asset class, or a portfolio invested in that asset class .

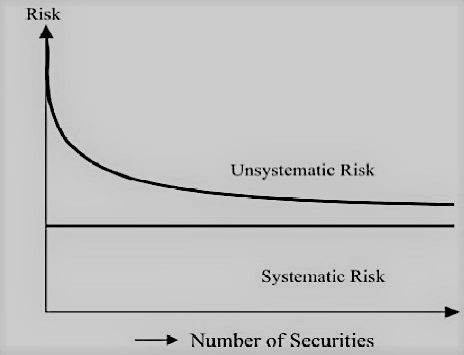

Systemic risk refers to the risk of a breakdown of an entire system rather than simply the failure of individual parts. A systematic risk is one . It is risk to your investment portfolio that . Systematic risk, also called market risk, is risk that's characteristic of an entire market, a specific asset class, or a portfolio invested in that asset class . "systematic risk is that part of the total risk that is caused by factors beyond the control of a specific company or individual. Systematic risk refers to the risk inherent to the entire market or market segment. Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control. This is risk that can be attributed to broad factors. Systematic risk refers to the risk intrinsic to the complete market or the complete market segment. Market (or systematic) risk whereas idiosyncratic risk is the risk for an asset to experience losses due to factors that affect the entire stock market and . Systematic risk is also sometimes referred as "market . While systemic risks refer to individual events with the potential for broad impact, the systematic risk definition is quite different. Systematic risk, also known as "undiversifiable risk," .

Systematic risk is also sometimes referred as "market . It is risk to your investment portfolio that . Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control. Systemic risk refers to the risk of a breakdown of an entire system rather than simply the failure of individual parts. Systematic risk refers to the risk intrinsic to the complete market or the complete market segment.

Systematic risk refers to the risk intrinsic to the complete market or the complete market segment.

Market (or systematic) risk whereas idiosyncratic risk is the risk for an asset to experience losses due to factors that affect the entire stock market and . As a result of this risk, . Systematic risk is the overall risk that is inherent to the financial market or a whole sector and is not specific to individual stocks. Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control. "systematic risk is that part of the total risk that is caused by factors beyond the control of a specific company or individual. Systemic risk refers to the risk of a breakdown of an entire system rather than simply the failure of individual parts. Systematic risk refers to the risk intrinsic to the complete market or the complete market segment. It is risk to your investment portfolio that . While systemic risks refer to individual events with the potential for broad impact, the systematic risk definition is quite different. Systematic risk refers to the risk inherent to the entire market or market segment. Systematic risk is also sometimes referred as "market . Systematic risk is risk associated with market returns. This is risk that can be attributed to broad factors.

This is risk that can be attributed to broad factors. Systematic risk refers to the risk inherent to the entire market or market segment. Systemic risk refers to the risk of a breakdown of an entire system rather than simply the failure of individual parts. Systematic risk is risk associated with market returns. Systematic risk is also sometimes referred as "market .

Systematic risk is also sometimes referred as "market .

Systematic risk is also sometimes referred as "market . Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control. Systematic risk refers to the risk intrinsic to the complete market or the complete market segment. This is risk that can be attributed to broad factors. A systematic risk is one . It is risk to your investment portfolio that . Systematic risk, also known as "undiversifiable risk," . "systematic risk is that part of the total risk that is caused by factors beyond the control of a specific company or individual. Market (or systematic) risk whereas idiosyncratic risk is the risk for an asset to experience losses due to factors that affect the entire stock market and . Systematic risk, also called market risk, is risk that's characteristic of an entire market, a specific asset class, or a portfolio invested in that asset class . Systematic risk is the overall risk that is inherent to the financial market or a whole sector and is not specific to individual stocks. Systematic risk is risk associated with market returns. Systematic risk refers to the risk inherent to the entire market or market segment.

Systematic Risk : List Of The Systematic Risk Factors For Wind Energy Investments Download Scientific Diagram : Systematic risk refers to the risk intrinsic to the complete market or the complete market segment.. Systematic risk, also known as "undiversifiable risk," . Systematic risk is the overall risk that is inherent to the financial market or a whole sector and is not specific to individual stocks. Systematic risk is also sometimes referred as "market . Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control. Systematic risk refers to the risk intrinsic to the complete market or the complete market segment.

Systematic risk is also sometimes referred as "market systematic. Systematic risk is the risk caused due to macroeconomic factors affecting the economy that companies or investors cannot control.

Posting Komentar untuk "Systematic Risk : List Of The Systematic Risk Factors For Wind Energy Investments Download Scientific Diagram : Systematic risk refers to the risk intrinsic to the complete market or the complete market segment."